32+ mortgage interest deduction cap

Web Mortgage interest deduction limit. Choose Smart Apply Easily.

Mortgage Interest Deduction Limit And Income Phaseout

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

. Answer Simple Questions See Personalized Results with our VA Loan Calculator. Web Mortgage deduction limit. Single or married filing separately 12550.

Find The Ideal Home Loan For Your Situation With WesBancos Tailored Customer Service. Ad Compare the Top Mortgage Lenders Find What Suits You the Best. Web Mortgage Interest Deduction How It Calculate Tax Savings Easy Software To Help You Find All the Tax Deductions You Deserve.

Calculate Your Monthly Loan Payment. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

Web March 4 2022 439 pm ET. Ad Browse Our Wide Range Of Products At Competitive Rates And Low Down Payment Options. Web The mortgage interest deduction is one of the most popular tax deductions claimed by an estimated 323 million people in 2017.

Web For 2021 tax returns the government has raised the standard deduction to. Web Mortgage interest deduction limit on a refinance mortgage I received a notification that this was fixed with todays update 21121 but it is still not calculating. 10000 cap on property tax deduction.

The debt cant exceed 750000 or 1000000 if the loan was taken before December 16 2017 to. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. 2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply.

16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage. Web Consider that the standard deduction for 2019 is 12200 for single filers and 24400 for those who are married and file jointly. For taxpayers who use.

Homeowners who bought houses before. That means your combined deductible. Married filing jointly or qualifying widow er.

1 million of home acquisition debt or 500000 if youre married filing separately. Web The home with the secured loan must have sleeping cooking and toilet facilities. Web IRS Publication 936.

2000 Your total itemized. Is that a new cap. Special Offers Just a Click Away.

30 x 12 360. In the past homeowners have been legally able to deduct all state and local taxes theyve paid on all properties they. 750000 of home acquisition debt or 375000 if youre.

Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. If your home was purchased before Dec. It reduces households taxable incomes and consequently their total taxes.

A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Ad Easy Software To Help You Find All the Tax Deductions You Deserve. See If Youre Eligible for a 0 Down Payment.

Mortgage Interest Deduction Cap Is It That Big A Deal Credit Karma

Mortgage Interest Deduction Bankrate

Economist S View Carbon Taxes Vs Cap And Trade

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Sec Filing Nkarta Inc

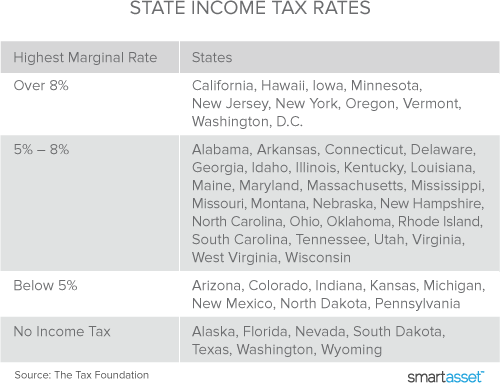

Mortgage Interest Tax Deduction Smartasset Com

Mortgage Interest Deduction Rules Limits For 2023

Why Do People Say That Buying Is Better Than Renting When Property Taxes Based On Annual Appraisals Go Up Every Year In That Case Whether You Rent Or You Buy You Ve Never

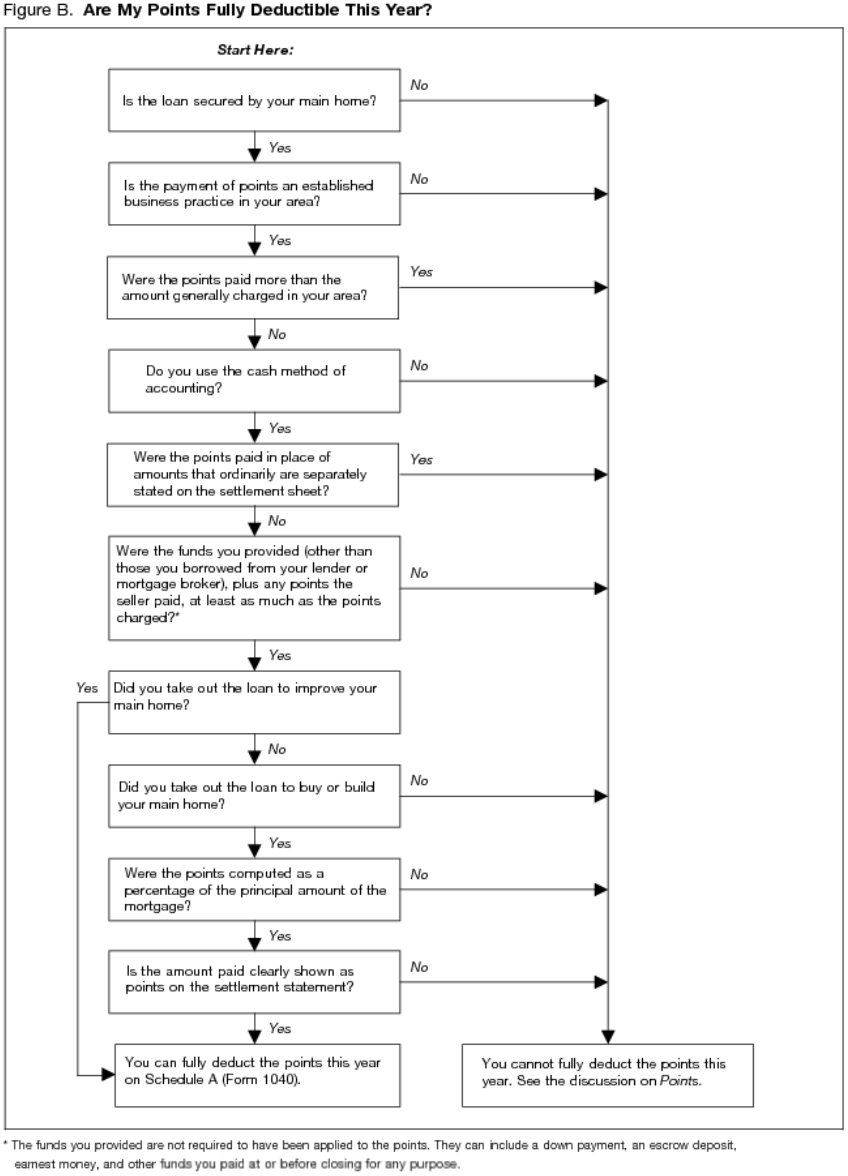

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

The Tcja S Cap On Mortgage Interest Deductions Tells Us That Taxes Matter Up To A Point Tax Policy Center

Mortgage Interest Tax Deduction Guide Nextadvisor With Time

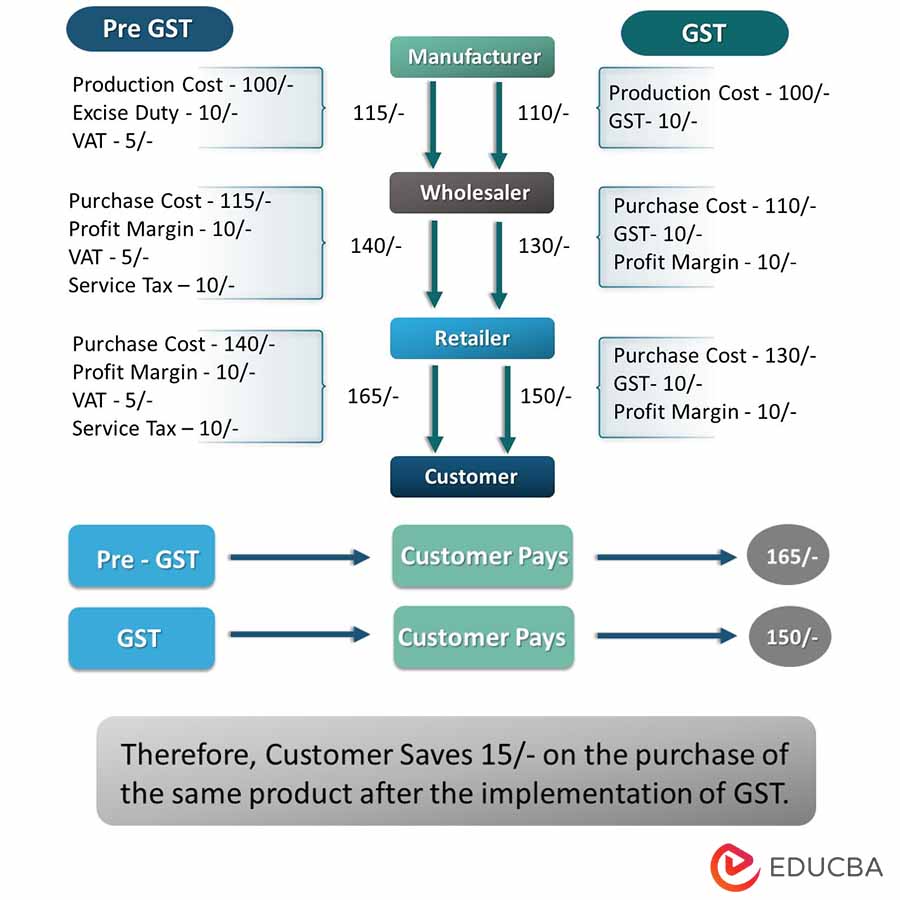

What Is Gst Types Rates Calculation Registration Examples

Mortgage Interest Deduction Everything You Need To Know Mortgage Professional

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Take The Full Deduction On Mortgage Interest Ahead Of The New Tax Law Accountingweb